What We Do

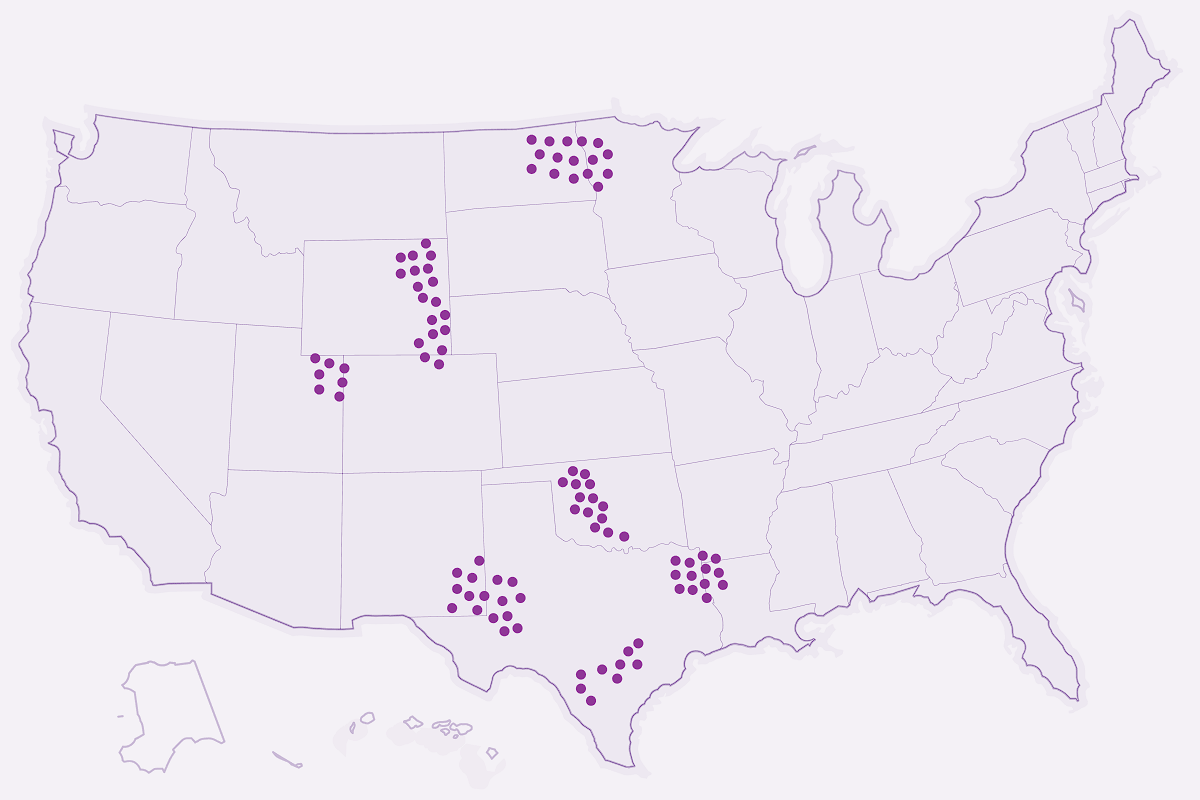

Pheasant Energy is a Fort Worth based upstream oil and gas company. Our primary focus is in the mineral, royalty, and working interest subset of the industry.

Pheasant Energy is a Fort Worth based upstream oil and gas company. Our primary focus is in the mineral, royalty, and working interest subset of the industry.

Our team analyzes a high rate of opportunities and a proven history of transacting quicker than anyone in the industry.

Pheasant Energy has roots back to the 1930s when the first oil and gas rights were purchased in the Moore Family and was carried forward by J. Hiram Moore, Ltd. beginning in the 1950s.

Track Record

The mineral investment world is facing unprecedented challenges.

As oil and gas prices flirt with historical lows, energy and mining companies are restructuring, renegotiating loans with banks, and declaring bankruptcy.

Under these perilous conditions, some great opportunities surface for those who want to buy mineral rights.

Mining operations are restructuring at an unparalleled scale. And mining assets are being shuffled at an unprecedented speed.

Mineral sellers are busier than ever and plenty of opportunities surface for the investors.

Deal flow is assured by the high volume of fire sale mineral rights transactions. But in these trying times, a mineral rights sale is a balancing act.

On the one hand, buyers can profit if they know how to buy mineral rights in an undervalued market while on the other hand, they must mitigate more risks.

Is the investment worth it

Oil futures prices are also bullish.

Prices went into super contango during the global pandemic, meaning short-term futures contract prices are lower than those of long-term contracts.

But understanding which assets will have the most value and for whom is not so easy to decipher. Matching the royalty buyers and sellers requires extensive networks, deep knowledge of basic economics and market dynamics, and thorough due diligence..

With this market knowledge comes the speed and resourcefulness to seize opportunities as they arise.

In a market downturn assets sell for substantially less on the dollar, but not all experienced investors will touch these deals.

Investors who want to purchase mineral rights need to understand the myriad of factors that determine the value of mineral, and oil and gas royalties. Buyers may be in a position to negotiate more favorable terms, or better off hedging market risk through a sale or purchase option transaction.

Producing &

Non-producing Mineral Rights

Producing &

Non-producing Royalty Interests

Overriding Royalty Interests

Non-operated Working Interests

Leasehold Interests

Finding It Right

Online auctions and marketplaces are making it easy to connect buyers and sellers.

Most deals, however, take place in a decentralized manner. Because the majority of developable resources lie on private land, private deals negotiated with property owners dominate the market.

The best deals and pricing are found in private network deal flows, where terms are more flexible. Both mineral owners and buyers often have very specific needs. Matching buyers and sellers can require a high level of expertise. More deals, therefore, are completed by private placement, negotiated sale, or directly with the seller.

Types of purchases

How mineral interests are bought and sold depends on the type of ownership. Although they can be bought outright, more commonly, interests are sold in the form of royalties, leases, or production payments.

A mineral royalty is a payment to a mineral owner in exchange for the right to explore and produce the minerals.

Royalties are typically a percentage of the value of the mineral, but they may also be a flat rate per unit (e.g., per ton of gold or copper).

Online marketplaces and auctions are a good place to start your mineral rights search. However, if you are seeking rights in a specific basin or acreage, or have other special requirements, you may have to solicit mineral owners who want to sell directly.

Brokers, data vendors and division orders can provide lists of mineral owners in a region.

The next step is to send out letters to solicit interest in selling. If working through a broker, they will use proprietary databases, networks and knowledge of current deals and pricing in basins to locate sellers.

An oil and gas lease is an agreement under which the lessor grants the lessee permission to explore and produce minerals on a set amount of acreage on a property. If the mineral is being produced, the lease will automatically be extended.

Oil and gas companies will work through their brokers or directly solicit mineral rights reserved by owners. The lease bonus—a payment for the exclusive right to engage in drilling activity on a property, royalty percentage of production, and the lease term and extensions will be negotiated.

Brokers also perform all due diligence. Surface rights usage and damage terms must be carefully negotiated to prevent future lawsuits.

Unlike leases and royalty interests, production payments are not considered real property. The payments represent interests in mineral, and oil and gas leaseholds that do not involve participation in the E&P operations.

In volumetric production payments (VPPs), for example, the investor provides funding to an oil company to finance production.

The oil company repays the investor with cashflows from the sale of production. The lessee receives payments based on their share of production, less expenses.

Less commonly, a lessee may be paid a net profit interest after operating expenses have been deducted.

Auctions sell mineral rights for both producing and non-producing properties.

In exchange for placing your rights on auction in front of their network of active buyers, they take a commission of the sale.

Most auctions are conducted online. Though most rights on private land are still sold through a private sale, auction sales have been found to bring a higher price for the mineral rights owners.

Mineral interests on public land, on the other hand, are sold at a public bidding auction (federal and state lands).

Available parcels with government rights reserved are listed. The rights go to the highest “acceptable” bid in a sealed bid auction.

Broker deals can be accessed in several ways. Brokers list mineral rights for sale on online marketplaces.

When sellers do not want the deal to be made public, private placements and negotiated sales are preferred.

In a private placement, the broker draws on a network of investors to present the royalty buyer with high quality exploration and development projects.

The broker will typically have a long-term relationship with the mineral owner.

The firm will conduct thorough due diligence, economic analysis, and geological and engineering studies drawing on specialized knowledge of the basins and resources being sold.

A high potential property can bypass large auctions and be sold to a select number of buyers.

This method will be used when the buyer does not wish to go public with the sale.

The sale may also require specialized engineering, geophysical and other reports.

When taxes are in arrears, counties may put mineral, surface, and royalty rights up for sale.

The original owner may redeem the property, however, within a redemption period (e.g., 2 years) by paying the arrears and penalties.

During this period, payment of royalties from the date of sale will be put in suspense and eventually paid out to you, the buyer, if the owner does not redeem the mineral rights.

Many oil and gas projects are for sale because they are no longer economical in the current low energy price environment.

Some mineral interests are being repossessed by banks. These sales are usually listed on online marketplaces.

Our mineral right brokers have developed a step-by-step guide to help you sell your mineral rights at the best possible price.

Do Your Due Diligence

Investors face challenges during market booms and busts. Production estimates often inflate during booms, especially in hot areas like the Permian Basin, where new wells can drain older ones. Over drilling leads to production declines, and understanding each project’s technology is crucial for estimating royalty revenues.

A study by The Wall Street Journal found that from 2014 to 2017, two-thirds of fracking companies’ projections were overestimated by 10–50%. Additionally, foreign interest from large miners can drive up prices, making market prices less reliable.

When mineral prices fall, forecasting becomes tricky, leading to inconsistent deal terms. Increased fire sales and strategic deals create scattered terms. Auctions for bankruptcies can attract many bargain hunters, driving prices up. Brokers encounter various strategic buyers seeking specific value amid chaotic activity.

Factors like property rights and royalties must be considered in due diligence. Payments to tribal groups can reach hundreds of millions. Environmental oversight of oil and gas projects has weakened during the pandemic, and investors should be aware of key dates. As the 10-year anniversary of the BP oil spill nears, non-compliant projects may face shutdowns, and 2020 being an election year raises concerns about drilling safety regulations.

Simple Steps

Give us a call at (817) 251-8282 or use our form in order to take the first step towards getting your offer.

Heightened risks in today’s environment

Investors in mineral resources currently face higher risks across the board—price, counterparty, credit, and so on. But where risk lurks in investment markets, opportunities also arise. Although price risk is higher in a market in contango, for instance, historically super tango markets have rallied.

A drop in energy demand and slow down in mineral extraction will reduce royalties.

The value of royalty rights can be increased in various ways.

Aggregators provide value by bundling mineral interests across parcels of land.

Ultimately, specialized and inside knowledge of pricing and deal trends allow more value to be extracted from a deal.

A number of oil and gas companies have filed for bankruptcy.

The first question asked is, will I still receive my royalty payments?

Of course, there is the risk the royalties will stop.

Several current bankruptcies in the host Permian Basin are still paying royalties.

If a buyer is found, royalty payment streams could flow uninterrupted. These terms and contingencies should be clearly negotiated in the agreement.

Since energy is an essential good, energy production continues uninterrupted even during global pandemics.

Nevertheless, market fears arise over attempts to invoke force majeure and not pay out royalties.

Owing to a lack of storage, the risk exists of oil buyers voiding contracts. A producer could choose to shut in wells for a period of time rather than sell at current low prices.

New Mexico, for example, has allowed oil and gas companies leasing state land to shut down for at least 30 days without penalties. Other state land management offices have followed New Mexico, citing low oil demand prices and consequently a lack of available storage.

The owners of mineral rights do not always get what they bargained for.

A common grievance is the discovery that post-production costs, which include pipeline transportation, are being deducted from royalty payments.

Lack of disclosure over how many drilling companies are operating on the parcel, active natural gas wells, property boundaries, and so on, may lower royalty payments.

More recently, complaints of cross drilling lowering output have arisen. Unless the buyer knows to ask these questions, however, caveat emptor prevails.

Since many mineral rights are sold as split estates, buying rights on properties where the homeowner has knowledge of them will reduce delays from community backlash and possibly litigation.

A transfer of mineral rights may appear on the actual deed but not subsequent deeds, so a thorough property title search is required.

Need of Broker

Taking into consideration the myriad of factors affecting the value of mineral interests, an experienced broker ensures all basis are covered to derive a fair market valuation.

Yet once a value is decided on, the terms can become more complex to negotiate.

Higher royalties than the standard one-eighth of production are being negotiated. Different royalties can be set for each type of hydrocarbon.

Such minor adjustments in the negotiating process can generate significantly higher cash flow for a project.

75+

1000+

100K+

Get in Touch

With big oil and small nimble developers actively seeking deals, a broker needs to swiftly and decisively locate and execute deals, all while negotiating the most favorable terms.

Pheasant Energy and its affiliates participate in mineral rights in all investment forms as both an energy company and investor.

We invest as public trusts and private LPs, as well as act as owners/operators and managers of interests in mineral resources.

From these different strategic viewpoints, we analyze a high volume of opportunities at any one time.

This insight means you are never negotiating blindly in an otherwise opaque market for mineral deals.

Knowledge and networks are negotiating power and allow us to extract the highest value from your mineral rights sales and purchases.

Since 1930’s

Pheasant Energy is primarily a non-operating oil and gas company, with the exception of joint ventures in working to develop existing positions and those within our management division.