Lots of Colorado property owners know that mineral rights are different from land-owning rights meaning an individual could buy/own property while an oil/mining company or even an investor would own the rights to the minerals under the soil.

So, they could either lease out their rights if it’s an investor or if an oil company steps in and starts preparing the land for mining or drilling depending on the minerals in the ground without giving the landowner a dime.

So, how does mineral rights work in Colorado?

Property ownership in Colorado involves two levels of ownership.

They are mineral rights and surface rights. Understanding the major overlaps and differences between these are important to every land buyer, seller and property owner.

Purchasing land in Colorado today is a dream come true for a majority of individuals due to the high value of the land and the mineral resources located in the ground. The availability of mineral resources has made land buying and leasing a serious business in Colorado.

Even with the current sluggish price of oil, the problems with understanding mineral rights in Colorado continue to stall.

A few decades ago, drilling for oil and gas in Colorado was considered a threat to the landscape of properties. However, the development of the oil and gas industry combined with the frantic pace of the real estate market in Colorado caused the rapid sale of lands and their rights, both surface and mineral.

With the emergence of technology to help with hydraulic fracturing, different areas that were considered impossible to drill are now considered a den of oil and gas.

Now lots of property owners are more sensitive to the topic of mineral right ownership before they make a sale.

If this has taught us anything, it is that technology is developing at a rapid pace that makes different things that were impossible to become possible.

Mineral rights are those rights that give a person/business the legal right to explore, remove and sell natural resources found beneath the soil surface.

These resources include oil, natural gas, gemstones, coal, precious stones and metals. Asides from these, people also discover elements such as scandium and uranium.

However, ownership of these rights is extremely fragmented as lots of properties usually have one or two ownership rights unrecorded or dozens and hundreds of rights owners can be associated with one small-sized ranch so you have to do proper due diligence on any property before you complete a purchase.

Surface rights as the term indicates are rights to everything on the exterior or upper part of the land. This includes physical edifice such as your house, garage, storage sheds, yards, and barns.

Access to water resources or any other substance not too deep in the soil can be classified under surface rights as subsurface rights.

People who own surface rights are allowed to practice crop farming on the land as well as erect structures the way they like. You can also dig the land to set up your septic system or underground storage tanks.

Severance of mineral interests in Colorado is very much possible as it requires the landowner to separate or give up the land ownership rights to someone else.

This severance splits the ownership of mineral rights from ownership of surface rights leaving the owner to do with as they please.

If you as an owner of the land are not sure what the ownership of yours includes, you have to go check the title of the insurance policy or the vesting deeds. There you will find all the references to mineral rights in your land.

The only disadvantage of this is that you may not see the information concerning the present owners of the mineral resources and would require a search outside the real estate records.

The preferred place to conduct your search is the Colorado Oil and Gas Conservation Commission.

They should be open to providing you with the necessary information about the current owners and use of mineral rights. When you want to carry out this research, you have to go with a real estate lawyer with a speciality in such area matters.

The most common mineral in Colorado include:

To gather information on mineral rights in Colorado you would need to start your research at the Colorado Oil and Gas Conservation Commission.

At this commission, you request the title commitment of the property. In this deed, you will find details of the owner of the mineral rights.

However, you have to properly observe the document to understand all clauses that apply to the document.

This is because most times there are references that exclude the mineral rights or even remove insurance over some minerals. You have to thoroughly understand each clause before making any decision on any property.

When the title commitment document does not offer a clear picture of mineral rights, buyers can find alternative means to obtain information on the minerals.

You can obtain a mineral title opinion on the land from an attorney that specializes in mineral rights.

You can also use the services of companies and individuals who specialize in researching such cases and submit a detailed report on the ownership of all associate rights. They will charge you based on your location of the property, time budget, the complexity of ownership, and constraints of the land mineral rights.

Unless you possess the required knowledge in this type of business, it would be wise to employ the services of a skilled attorney or researcher. The loss of a failed or incorrect research would cost more than a successful one.

The state of Colorado declared in Public interest that mineral right holders foster and regulate the balanced, and responsible, production, development and uses of the natural resources in the state of Colorado in a manner that matches the protection of public health, welfare, and safety including protection of wildlife resources and our environment.

Mineral rights holders are expected to pay severance tax which is a tax levied on non-renewable natural resources removed from the earth.

Anyone who receives income from mining non-renewable natural resources and oil and gas production must file a severance tax return.

You are also mandated to pay severance tax even if you realise no profit from the business.

Colorado has currently set its setback laws to 500 feet from statewide buildings and 1,000 feet from high occupancy buildings. The reason for the setback rules is to keep the communities and environment around oil and gas development areas safe.

A surface use agreement is an agreement between the mineral owner and the surface owner that will guide the relations between both parties.

This agreement comes into play especially when both surface rights owners and Mineral right owners have different visions for their rights to the properties.

While in some states it is mandatory to have these rights before the start of production, it is not in Colorado.

Mineral rights buyers typically do not like to buy properties from the locals.

They prefer to buy the rights from non-producing mineral rights sellers who sell their land for under $1000/acre. Once bought, the value of the land then drops to $0 to $250/acre.

You can lease your mineral rights values to someone else to sell. This comes after they that if a mineral lease expires on a property, the property is said to be open and cost as much as $0 to a few hundred/acres.

Non-producing mineral right values are usually stayed away from because their cost value is under $1000/acre. However, with their status, such land would go from $0 to $250.

Properties found around mineral producing areas do bear the triple effect cash flow methods.

For example, if a property would cost $300 a month because it was in a producing area, you would have to pay $300 multiplied by 12 months multiplied by 3 years which would give around $10,800. So the larger the cost of renting the property, the more the valuation of the property.

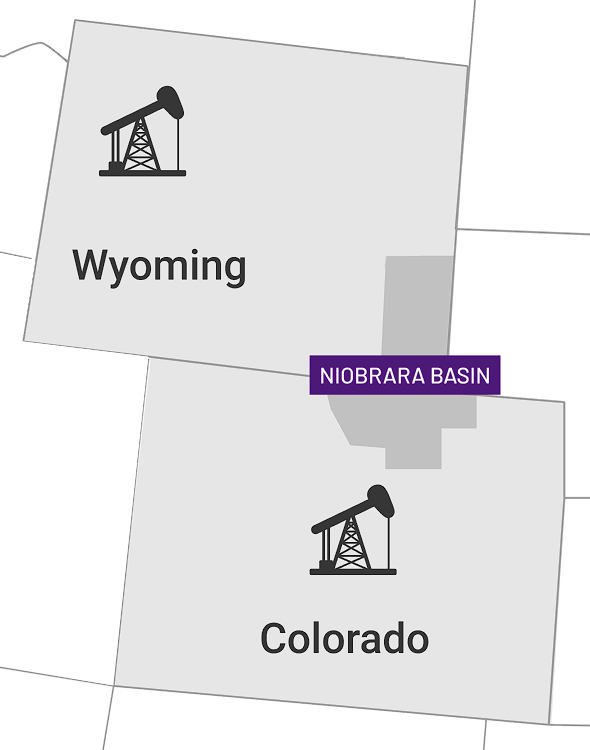

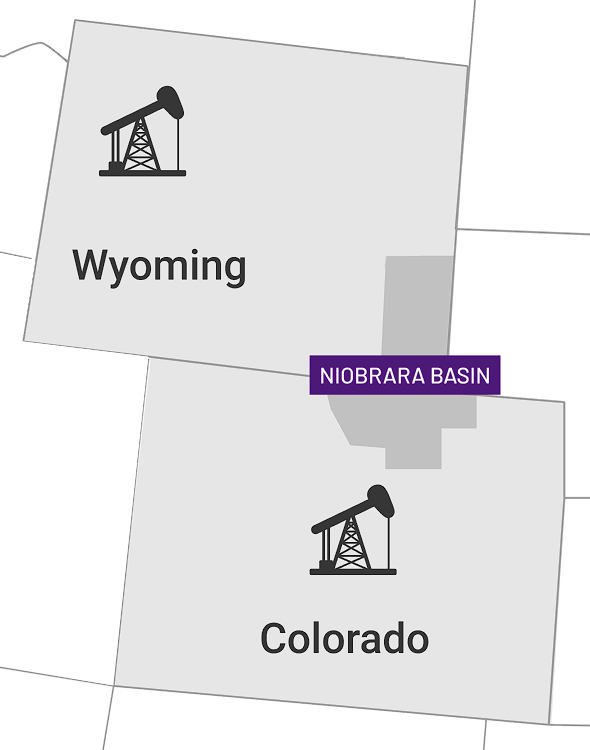

Colorado offers extensive shale resources that can put money in the hands of property owners. The state resources are shared by basins and the major basin is the Niobrara Basin. Since Niobrara Basin is one of the biggest in the US as many activities happen around this area stretch over to South Dakota, Nebraska, and Wyoming.

If you want to buy mineral rights in Colorado, Pheasant Energy is one of the most trustworthy brokers with more than 75 years of experience. With our vast experience in the business, we are able to properly value your mineral rights, royalty interests and oil and gas royalties to the best affordable price.

In case you want to sell your mineral rights and want upfront payment, it can also be arranged as Pheasant can work with you to provide you with the best purchase price.

Many mineral right owners are always looking for the right value to sell.

The only way to determine the accurate mineral rights value is to sell the mineral rights.

When you sell these rights in a competitive environment like Colorado, you’re sure to get the highest market value possible.

A unique part of mineral right ownership is the concept of time.

Nobody knows if or when the minerals will be drilled. But with the rise in the price of minerals in America, mineral right owners must consider the offers made for these minerals because of the money involved and because there’s no sure antecedent in the mineral rights industry.

You can wake up tomorrow and discover that your mineral rights cost absolutely nothing or that it could cost more in the future because the mineral became more valuable. The only sure thing about mineral rights is the cash at hand which makes it important to conduct a sale.

If you own mineral rights and want to sell them, you can come over to Pheasant. Our team can help you determine the value of the mineral rights before putting it on the market. Regardless of the reason for your sale, we will help you make the right decision in your situation.

To transfer mineral rights from one individual to another in Colorado is easy. There are no reservations or exceptions included except it is a lease.

The transfer of mineral rights transfers all the rights concerning oil, gas, and other mineral resources to a grantee.

The grantee upon receiving and completing the transfer process gains the right to access the mineral rights for exploration, mining, development, and drilling on the land for its mineral resources.

To transfer mineral rights:

Currently, Pheasant Energy operates in Weld County and Laramie counties which are part of the Niobrara Basin. You can reach out to us on our website or email, and we would respond immediately.

Owning and leasing mineral rights in Colorado has become a lucrative business. With recent innovations in technology, areas that had little or no activity are now seeing wells spring up all over the land.

Buying a property without mineral rights is not a bad idea as you stand to gain as the owner if anytime soon, they decide to explore the mineral rights of your property. You can sell for whatever price you want which would compensate for all the times the land was lying around idle.

The only individuals who are sure of owning rights t their properties are those who inherited the properties from their family and even in this scenario, it is not 100% clear as many properties do have one clause or the other tied to the mineral rights.

However, if due diligence is done and there are no attached clauses to a property, then you are the owner of the mineral rights to your property.

75+

1000+

100K+

Simple Steps

Give us a call at (817) 251-8282 or use our form in order to take the first step towards getting your offer.