Mineral rights in Louisiana are governed by the Louisiana Mineral Code, which differs from the law of other states. Under Louisiana law, you can’t own natural resources such as oil/gas under your land until you begin drilling for oil/gas. Ownership begins with production, even after a lease. With that said, let’s discuss the types of land rights in Louisiana.

Mineral rights in Louisiana give you access to natural resources such as oil or gas located under the land in Louisiana. To better understand this, we must state that the minerals involved in this case include oil, gas, underground water, coal, sulfur, and any other substance occurring naturally in the ground.

Mineral and surface rights come with land ownership. They are related but different, in the sense that when a person purchases land, they may own everything above and below the ground or only above the ground. The rights to exploit natural resources such as oil/gas found below-ground may be owned by multiple people according to the law covering Louisiana mineral rights.

Purchasing Louisiana mineral rights is different from the way other states operate. Unlike other states where people retain ownership forever after purchase, Louisiana law states that Louisiana Mineral Rights revert to the original owner 10 years after the date of sale or the date of the last production.

This is one reason why Louisiana mineral rights are exclusive, and people should be cautious concerning Louisiana mineral rights because of Louisiana’s Napoleonic legal system. Make sure you understand everything about the rights of land in Louisianan and other land-associated laws before making a purchase.

According to the mineral code law, no one may own a fugacious mineral such as oil/gas, as ownership only begins when the oil or gas is drilled and extracted from the ground into tanks or pipelines. What a person may own is the ability to extract oil or another mineral from the ground. If the person with this ability is not the landowner, what the person has is called mineral servitude. This works for people who lease properties.

Under Louisiana law, mineral servitude allows a person to explore and develop their property for the production of natural resources such as oil, gas, or other minerals located on the site and also claim possession and ownership of the mineral rights.

Surface rights are those that cover the ability to oversee and control everything on the surface of the land according to law. The holder is permitted by law to build, plant, and sell crops and timber on the land, even on a lease. They may also use the surface water and lease the surface rights to the land.

In cases where there is a conflict of interest between the holders of mineral and surface rights for a parcel of land, the law requires that the holder of the mineral rights has dominance over the land with regard to the reserved natural minerals such as oil or gas.

So, the owner has consent to use the surface of the land for exploration, development, drilling, producing, marketing, transporting, and storage purposes; but under the conditions reserved, must endeavor to not cause any undue damage to the property to avoid legal consequences.

The search process may be tricky due to the amount of information not included in deeds. To get all the pertinent information for any property, prospective landowners have to research property records and historical deeds thoroughly.

Since Louisiana does not use the Public Land Survey System but rather the old system which requires that the properties be listed according to the block, sub-division of where the property can be found, and lot number, it is essential to examine relevant documents to confirm all the information written on the land deed.

The search can take a long time and be difficult to handle especially when the property has been leased several times. It requires looking for information concerning the number of times minerals have changed hands and finding all the gaps that exist in the records to determine who currently owns the mineral rights. However, it is possible to hire a professional body to look for records of the property in question.

You can also check, for a small fee, the records of county properties to determine who owned the property or minerals or if there is a lease covering them.

To claim mineral rights in Louisiana, the party seeking the oil or gas needs to conduct title research to confirm and determine that the state or state agency does own the land and rights of a property.

If after the research, it is determined that the land belongs to the state or a particular state agency, the party interested in the property must provide a legal copy of the title deed where the state or state agency relinquishes their claim and the prospective owner acquires their interest in the property including the rights to any oil, gas, or other minerals.

After providing the title deed, the party has to determine whether the land has a legal area. If it does, the party must provide a legal copy of the judgment that establishes the state or state agency owns it. After providing these documents, the party can now claim payment of royalties on the property.

When owners die, their estate, the claim to any minerals, and payment of royalties generated from their property are transferred to whoever is designated in their will. Before the rights are transferred, a title insurance company or an attorney at law must conduct and complete a title search to make sure that the deceased owners had a rightful claim to the minerals.

In the process of this research, the rights to any minerals contained on the property will be separated from the surface rights and the attorney will create a mineral deed with a legal description of all the resources (oil, gas, precious stones, etc.) that would come under the possession of the new owners, including any royalty payments.

However, if the rights are subject to a lease to a business or individual, the rights executor or estate executor can transfer the title on the lease to the new owner to afford them the chance of collecting any royalty entitlement attached to the land or estate.

Whenever a person organizes the sale, lease, or any change of their ownership of mineral rights, they are mandated to pay some tax from the royalty payments they receive. Some of the taxes mandated include royalty-based income tax, ad valorem tax, and severance tax. Each of these taxes goes to a specific government entity.

In Louisiana, mineral rights owners and landowners pay ad valorem and severance taxes to their respective bodies. Ad valorem tax is a tax based on the assessed value of the land acquired. The rate of ad valorem tax paid is not higher than 10% of the value of the minerals or oil and gas and the value of the land. This tax applies when production begins actively on a property.

The severance tax is a tax generated from oil and gas extraction in Louisiana. The tax rate is based on the choice of the state government and the extracted minerals. However, the severance tax differs according to mineral resources, and what landowners pay on oil/gas can provide a significant revenue source for Louisiana.

It is impossible to place a particular figure on the cost per acre. It is challenging to calculate the average price per acre because no two properties have the same value.

To determine the cost of mineral rights per acre, you need to rely upon an estimated value through existing offers. You can organize a sale by putting out an ad, selling minerals, and through the various offers you receive from buyers you can estimate the average value per acre in Louisiana.

Prior to owning any mineral rights in Louisiana landowners only have mineral servitude, which is a document that gives a landowner the right to exploit minerals and drill oil gas out of the ground.

The landowner can enter into an agreement to lease the mineral servitude to a lessee who will then have free reign to extract whatever minerals they find. The main term of the lease is between 3 to 10 years and can never be more than 10 years long, as that’s when the mineral servitude will revert to the owner.

Determining the value for non-producing mineral rights is not possible because of the subject of cash flow. Aside from cash flow, the risk associated with non-producing wells makes it challenging to come up with figures.

Determining a reasonable value relies upon the estimates of previous owners, but bear in mind that the cost of the resources could be very high as prices might fluctuate before production commences.

For producing mineral rights, the present value is based on the value of future cash flow. The future cash flow is determined immediately after the production of resources begins. So, there is no particular cost until production begins on a property.

Buying mineral rights in Louisiana is an easy step-by-step process that provides the buyer with a hassle-free experience. The required process involves getting information regarding making a claim on any royalties of the site. This requires recent checks on the copies of leases, payment of royalties, conveyances, assignments, sales, and maps to see the present status.

After this check, the value of the assets to be purchased has to be reviewed and analyzed, to know the present value of the resources before any offer can be prepared. Pheasant Energy is a trustworthy broker that can help you carry out these checks and even broker a deal with the seller on your behalf. For a small fee, they can help you handle your mineral rights acquisition, hassle-free.

If you want to sell mineral rights in Louisiana, it is also not a hard process. However, the sale may not be immediate, given that the property has to undergo analysis and surveillance before it is certified okay for sale, and you are ready to sign the contract.

If you want to sell your mineral rights, you will need to have your property analyzed and valued at the current market rate to see its worth before placing it on the market for sale. You can contract the sale to Pheasant Energy, a trustworthy broker that can help you evaluate the property and broker a deal for the right price for all parties.

You can wake up tomorrow and discover that your mineral rights cost absolutely nothing or that it could cost more in the future because the mineral became more valuable. The only sure thing about mineral rights is the cash at hand which makes it important to conduct a sale.

If you own mineral rights and want to sell them, you can come over to Pheasant. Our team can help you determine the value of the mineral rights before putting it on the market. Regardless of the reason for your sale, we will help you make the right decision in your situation.

In Louisiana, landowners can transfer the mineral rights for their properties to other people. These rights, known as mineral servitude, give new people the right to explore and drill the site to get the minerals. Transfers fall under Articles 11 and 22, Louisiana Mineral Code. To transfer such rights, the new owner has to acquire a copy of the deed for the site at a local courthouse in Louisiana in the same county as the property. Once the deed has been obtained, it must be reviewed to make sure the deed matches the description of the land in Louisiana and make sure that the so-called mineral rights are included in the property deed before you sign.

If the mineral rights value is excluded from the deed, it is necessary to search the previous deed to make sure they were not excluded. Once all information has been verified, an attorney can draw up a new deed for the transfer of the rights to any minerals on the property to the new owner. You have to review the new deed before you sign to make sure everything is included in the deed.

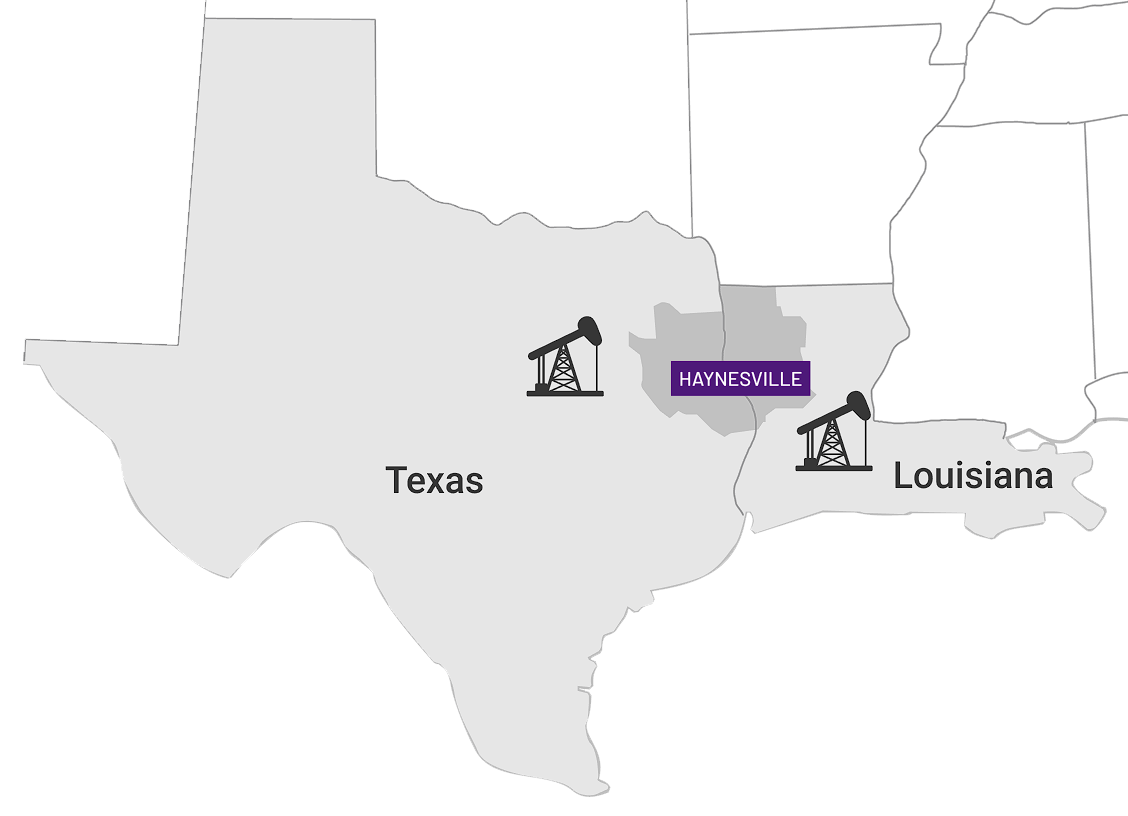

You can currently find Pheasant Energy operating in the following parishes in Louisiana:

These parishes all make up the Haynesville Basin.

The lessee of mineral rights can only keep those rights for 10 years before they revert to the owner. This is according to the law in Louisiana.

75+

1000+

100K+

Simple Steps

Give us a call at (817) 251-8282 or use our form in order to take the first step towards getting your offer.