Since the Lone Star state gave property owners rights to their minerals under the surface estate through property rights law in 1840, two main forms of investment have emerged across the country.

Investors either buy mineral rights outright or invest in royalty interests.

Is the lull in oil production an opportunity to invest in mineral rights in Texas?

Legend is that a Texas oilman can see the black gold bubbling to the surface. Although oil may not be seeping through to the surface, Texas wells are far from drying up.

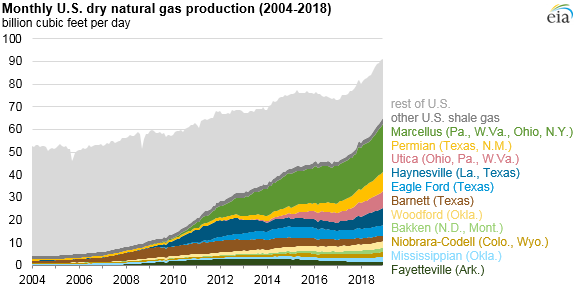

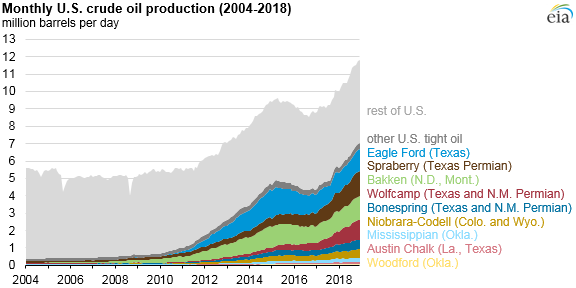

Over the last decade, oil miners have relied on advanced extraction technology to quadruple production in the state.

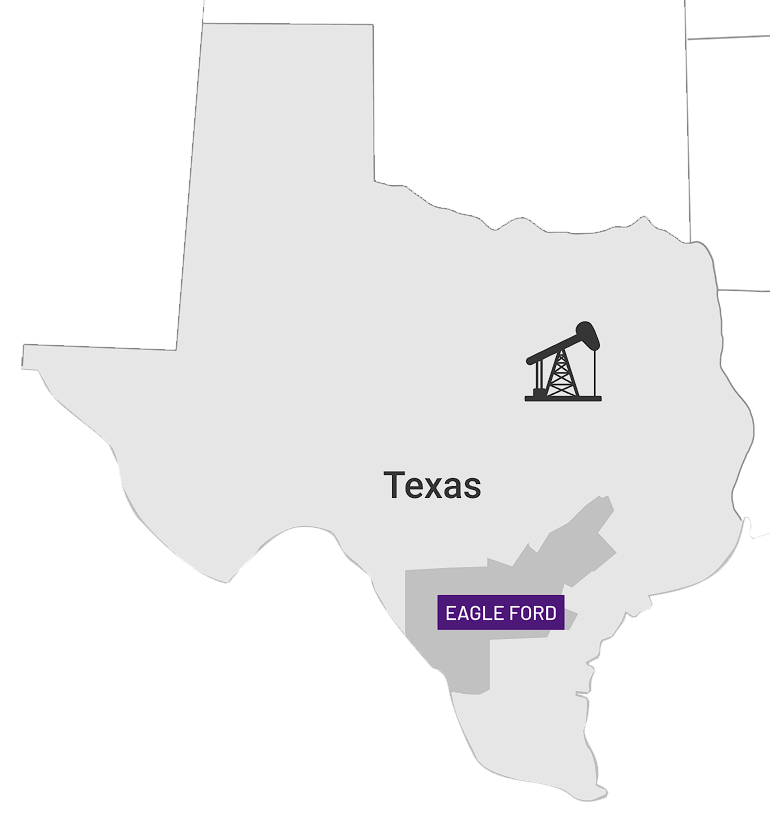

In Texas’ prolific Permian Basin, oil experts are forecasting future production that could surpass the monster Ghawar oil field of Saudi Arabia.

For outside investors, Texas is opening up more opportunities to participate in the shale bonanza. If you are looking to invest in mineral rights in Texas, this article explains how mineral rights in Texas work, including how to value, claim and buy and sell mineral rights in America’s largest oil-producing region.

The mineral rights on Texas land can be separated from the surface estate. As an investor, you can buy a unified estate including surface rights and below surface rights, or a split estate, only including the mineral estates. As part of the property transfer by deed, you also gain rights to future royalties and payments.

The most common way to invest in mineral interests in Texas is through a royalty interest in oil and gas leases. As a holder of a right to royalties in a mineral estate, like stock dividends, you will receive a portion of the revenues from the production in a stream of royalty payments. Lessees do not have other rights of ownership, however, such as the right to lease or sell the underlying mineral rights.

Texans like to do things big, and royalty payouts are no exception. Royalties averaging 12.5 percent have doubled in some hot basins like the Permian.

Texas wells pumped 1.85 billion barrels of oil in 2019, almost four times as much as the next big oil-producing state, North Dakota.

About 18–25 percent of the revenues from the sale of that oil went to royalty interest owners.

Of the $145 billion worth of mineral properties across Texas, which ones should you invest in?

Which ones will bubble black gold?

And how do you get in on these deals?

With high-speed trains, wind farms, and pipelines grabbing land in Texas, how safe are your mineral rights?

Fortunately, among the safest in the land. Texas law courts have been pioneers in developing the best protection for property and mineral rights owners.

What are mineral rights by definition differs across states? In Texas, mineral rights owners have rights to the oil, gas, salt, uranium and sulfur under the surface estate. If you also want the rights to other minerals—gems, copper, iron ore or zinc, for example—these additional rights need to be specified in the lease.

Most property owners lease their mineral estates and in exchange receive royalty and bonus payments. The surface rights owner is also obligated to provide a right of way easement to provide mineral exploration companies access to the resources under the surface.

The severability of mineral rights means many parties can own rights in the minerals below a parcel of land. This inevitably can create disputes among royalty interest owners. One recent legal dispute divided the mineral rights in sixteenths across heirs and private investors. One investor did not agree with the leasing of the parcels to an oil development company and sued for trespassing, even though he received his share of the royalties. As is commonly the case in Texas, the courts rule in favor of granting rights for mineral production

Texas is oil land. And in oil land , as well as in most states, the mineral estate is the dominant estate. A government entity, however, can expropriate or enforce an easement on your land if it is required to provide public services. Private entities delivering public services also make land grabs, including wind farms and pipelines.

In Texas, land and mineral estate owners are protected by eminent domain under the Texas Landowner’s Bill of Rights. If a government entity tries to appropriate your property, you have a right to obtain private appraisals and defend your rights in court. A judge could also determine that the appropriating party owes the landowner compensation for the loss of future income.

But what if an oil and gas company erects so much equipment that you cannot tend to your crops or causes damage? Such was the case when the Getty Oil company’s structures prevented one farmer from using his sprinkler system.

In 1971, the Supreme Court of Texas established the Accommodation Doctrine, which has been adopted in many states throughout the land. If the oil and gas company has an alternative way to extract the minerals, it must make reasonable accommodation to not impede the operations of existing businesses using the land.

Many people buy land without paying any attention to mineral estates. In oil-rich Texas, even if your land is in a county with low appraised mineral value, overlooking mineral rights could be a costly mistake. Consider the impact of the fracking frenzy in counties in the Eagle Ford Shale.

The value of mineral reserves in one county, McMullen, has skyrocketed 12.3-fold to $2.6 billion over the decade, making this small county of 800 people among the richest in America. Many property owners in counties across Texas have similar overnight millionaire stories

If you are buying or selling Texas mineral rights, here’s how to ensure you have ownership title.

In Texas, start by conducting a free search at the county clerk’s office for surface estate deeds and potential subsurface deed restrictions.

Be aware, though, that surface estate land deeds do not typically list mineral rights transfers. A mineral estate appraiser or title search expert can conduct a thorough search of royalty deeds and titles of mineral estates.

As mentioned, minerals can be part of a unified estate or severed mineral estate. Fractional ownership of minerals is commonly used among heirs to mineral rights. The Federal government has retained ownership of large swathes of mineral rights, both on public land and land it has sold to private parties. Landowners commonly sever and sell their mineral rights, often to big oil and gas exploration companies.

The most common way of claiming mineral rights today is by buying them at auction or through private sales . A mineral rights claim grants the holder the right to exploit and develop the mineral reserves These claims can be granted for separate minerals on the same parcel. For example, an oil and gas company may own the rights to the liquid minerals while a mining company has a claim on the gold or silver.

Under the Texas tax code, mineral interests are considered real property and as such, as on surface estates, property taxes are assessed annually. Although in Texas, the royalty owner only has to pay taxes on mineral rights if they are producing. If you are a lessee with a royalty interest in a lease, you will be charged tax on your proportional share of production revenues. If your interest’s value is less than $500, however, under the Texas Property Tax Code, you could be exempt from property taxes.

Like regular income, the IRS will tax you on royalty revenues as income earned. Fortunately, you can benefit from several tax-saving strategies, including depletion allowance and 1031 exchanges.

Buy low and sell high is sound investment advice. In the mineral rights markets, though, dozens of variables determine mineral rights value in Texas. So how do you know you are paying fair value? In the most prolific oil and gas producing state, an inexperienced buyer or seller can easily undervalue or overvalue mineral properties.

So what type of valuations can you expect in Texas?

Online mineral rights markets provide useful ballpark figures of what properties are going for. But most deals are not published. The highest value deals in Texas still circulate among an old boys club of brokers. Outside this club, information asymmetry could put you at a disadvantage.

If a non-producing property is being sold by a broker above market value, ask why?

He likely knows something the market does not. Big oil may be fracking on all the adjoining properties and bidding for the same mineral rights, in which case you could get a lot more than the fair market value offered.

As an owner, investor, and broker of upstream oil and gas mineral rights in Texas, Pheasant Energy uses its insider edge to help investors buy and sell mineral rights that fall within the expansion plans of E&P companies.

When a technological innovation called horizontal drilling opened up the Barrett Shale basin in Texas, investors around the world wanted a toehold investment. In 2007, 100,000 mineral royalty leases were signed in Tarrant County alone. Our clients were among the earliest investors. Although the value of Tarrant mineral interests peaked at $2.7 billion in 2015, Tarrant remains the richest mineral rights county in America.

Take note, though, most of those interests are owned by big E&P companies—and Texans. If you want to buy at the right place in the production curve in basins in Texas, or anywhere else in the country for that matter, you need homegrown brokers with their ears to the ground. With generations of experience valuing mineral rights, a broker can hear the oil flowing beneath the surface.

You not only need to be in the right location. To maximize your returns in oil gas minerals, you need to be in the right place on the oil or gas production curve. Many investors sold when they saw a reserve depletion in shale oil and gas production in 2016—2017, but not Texas insiders.

Prices for mineral rights can swing wildly at any stage on the production curve based on E&P company and analyst forecasts of potentially exploitable reserves.

When you are ready to sell your mineral rights Texas provides several options. They involve different levels of due diligence, though.

Pheasant Energy knows that everything is big in Texas. That’s why we made early strategic acquisitions in shale basins across Texas, as well as the country.

Over the last decade, oil production has quadrupled in Texas. Five of the 10 largest oils gas shale plays in the United States cross the Lone Star state.

Pheasant is active in the:

You not only need to be in the right shale but also the right strata and wells. With our large strategic shale footprint, we have our ear to the ground in each basin.

If you want to buy or sell mineral rights and royalties, Pheasant Energy knows where the best opportunities can be found.

In 2019, shale plays created a record $16 billion tax and royalty windfall for the state. The state collected $2.2 billion in royalties. Our private royalty investors had a profitable year, too.

Pheasant Energy is a multi-generational player across the upstream oil and gas value stream. Over the decades, we have expanded our homegrown Texas expertise to dozens of interests in oil and gas basins across the country. Exploiting our expertise and networks developed over four generations, we can close your deals in the mineral rights market faster than the rest.

75+

1000+

100K+

Simple Steps

Give us a call at (817) 251-8282 or use our form in order to take the first step towards getting your offer.