It is often thought of as valuable when ownership of mineral interests can be demonstrated, but even if none of them belong to anyone, the state treats them as valuable. In this section, we’re going to be looking at how mineral rights work in North Dakota.

As we all know, the holder of the right to the minerals (e.g., oil and gas) found underground is the legal owner. In other states of America, the right to real property, both surface and mineral, is owned by separate entities. But in North Dakota, it is allowed to own both for the real property except when you decide to sell one of them.

However, if the real property is not specifically owned by anyone, it is assumed to be owned by the Federal government. If an individual owns the North Dakota mineral rights but abandons the location for a period, say 20-25 years, the minerals will be deemed as abandoned.

Surface rights are those that grant the legal ownership of the surface area of any land. These include the right to use the land for farming and also any structures on it. The owner also has the right to dig to a certain level for installing a septic system.

With surface rights, you can convey or sell them to individuals or companies as they are yours. You cannot convey or sell mineral interests such as oil and gas as you have no right to them and, therefore, this can lead to a conflict of interest between landowners and mineral interest owners in North Dakota.

You can find the owner of any North Dakota mineral rights when you follow these steps:

There are two ways to find mineral interests records in North Dakota. These involve searching for the relevant records or employing a researcher who would act on your behalf. To get the information, you need to:

Title ownership of properties in North Dakota is divided into two types. The right to free use of the surface and the right of access to underground minerals like oil and gas. These offer their holders specific access to the various North Dakota mineral rights described here. Both grant the holders access to various parts of a property or estate. For example, anyone with surface owner rights as free use of the surface of the location for ranching, farming, commercial, residential, and other such activity.

In North Dakota, the mineral and surface owner rights can be held by the same person. However, in certain situations, marked North Dakota mineral rights may or may not be owned by the same person. These marked mineral rights will be explained to any person who wants to purchase the mineral or surface rights before the deal is complete.

To claim ownership of the oil/gas rights in North Dakota, you need to follow these steps:

To inherit your mineral interests in North Dakota, North Dakota law has a rule that the grantor must have transferred them to an appointee or transferred directly to you to take effect at a certain time.

To receive the mineral rights, an attorney must be present to complete a title search to determine the mineral interests to the lot owned by the grantor belongs to you.

If you’re inheriting the right to surface use from a grantor, a legal team will create a mineral deed with a description of every right you will receive.

If the severed mineral rights are under lease to companies, as the new landowner, you could have a right to earn interest or commission on them assuming you have overall ownership of the lot.

For rights owners, any income earned from the mineral royalties, sale, or ownership of mineral rights in North Dakota is subject to state and federal taxes. The amount you pay for tax depends on the income you earn from oil and gas production. If you sell oil and gas, you will pay capital gains tax to the state on the sale profit.

If you purchased the mineral rights, the difference between the price you paid and the amount you sold them for is the base for the tax you’ll pay. Rights owners must pay this tax to the state.

If inherited, the difference between the value when inherited and when sold will determine the base for tax.

The tax rate is determined by the income bracket of the rights owners and the time they have held them.

The value of ownership of minerals such as oil/gas is a difficult question to answer according to North Dakota law because each property is unique and yours might be close to that of your neighbor which can cause some differences in valuation. The type or nature of the resources also influences the valuation.

However, to get an estimation of the valuation of your property you can search a website that can inform you of the approximate value of mineral interests in North Dakota.

To know the value of leasing mineral rights, you will need to multiply the total bonus you received for giving access to production or drilling companies to extract the resources. To get the leasing value, you need to multiply your total bonus by 2x to 3x.

However, this is a way to calculate an estimation. The one true way of knowing the value of any mineral interests is to list them on the US Mineral Exchange and see what the market rates are for the mineral resources.

Unfortunately, there is little or no value to owning non-producing mineral rights because these rights will worth less than $1000/acre which is the expected amount. No mineral buyer would want to buy such low non-producing rights and end up stuck with them for years waiting for something to happen.

To get the value for producing mineral rights is quite straightforward in North Dakota. To estimate the value, mineral owners can sum the value of the last three royalty checks and divide the total by 3 to get the average value of one month’s royalty. So, then you can estimate the total cost of the lease contract you signed.

To buy mineral rights in North Dakota, you need to research the ownership at the County Recorder’s office to ensure the details correspond. You can do this research or contact an attorney or a broker to act as a researcher. Pheasant Energy, as a trustworthy broker, can help you handle the transaction and close the deal.

Selling mineral rights depends on the choice of the mineral owners. If you decide to sell the rights then you can meet with rights selling agents or mineral buyers directly such as Pheasant Energy who can broker a good deal.

To convey or transfer ownership of mineral rights to a new owner, the current owner of the rights has to engage a title insurance company or an attorney at a district court to perform a search of the property title. After separating the mineral rights from the surface rights, a specific mineral deed will be prepared with information regarding the transfer of the rights to the new owner.

The only factor that could delay a transfer is if there’s a current lease on the mineral rights of a property. The executor has to ensure that the mineral interests are transferred to your name so you can collect your due royalties.

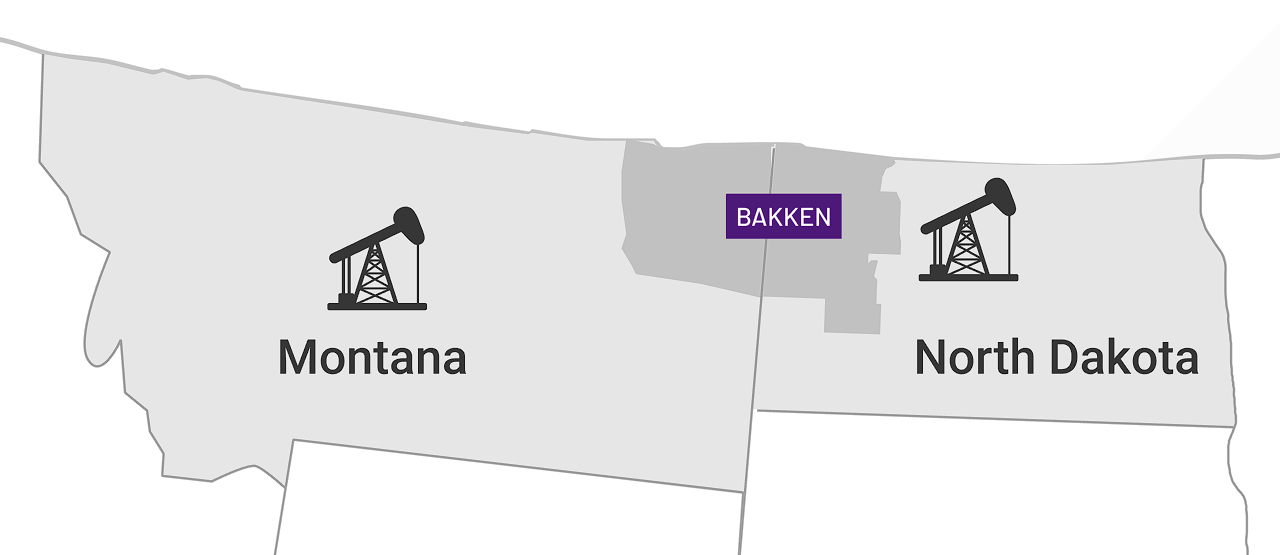

Currently, Pheasant Energy operates in:

Which are part of the Bakken Basin. You can contact them for advice and help regarding purchasing or selling mineral resources in North Dakota.

Here are some common questions about North Dakota mineral rights.

Mineral rights do not expire in North Dakota. When a person purchases them, they own that right forever or until they sell the rights to another individual. These rights do not expire at any point.

The mineral rights of a deceased person are passed on to an assigned body in the event of death. This assigned body can be an agent or a family member of the deceased.

Yes, you can. It is standard practice in North Dakota to sell the surface rights to a different entity or individual while the owner retains the mineral interest. But you must complete the necessary legalities.

75+

1000+

100K+

Simple Steps

Give us a call at (817) 251-8282 or use our form in order to take the first step towards getting your offer.