When you own the mineral rights to properties in Pennsylvania, you automatically gain the rights to the underground resources (oil and gas) for exploration and production. These mineral rights are different from the surface interest according to US laws.

Surface rights, on the other hand, gives the right to access the surface of a property for residential, commercial, agricultural and other purposes. With these rights, you can exploit the surface of their property to its fullest. Let’s provide more information below.

According to Pennsylvania law, a property can be divided into mineral rights and surface rights. There are various ways the surface and mineral rights can be separately held that will see the minerals separated such as oil and gas and coal etc. No matter how they hold these interests, under the law they all have rights.

The law recognizes that the mineral holder has the right to recover the mineral, while the landowner has the right to protect his interests from unreasonable encroachment or damage. Regardless of your experience in holding the surface title, someone else could own the mineral rights on the tract.

If you check the historical deeds of properties back in the nineteenth century, you will discover when the oil and gas rights were first separated from the surface estate and the experience the royalty owners went through. If you find any old deed that says “oil and gas excepted and reserved” then the surface was sold separately from the oil and gas property. Whenever you find such a statement in an old deed, you can assume that the oil and gas license have been separated from your estate. This is the first education you need to understand the history of mineral rights.

Mineral rights in Pennsylvania allow for private individuals to buy lands and own the right to develop and use any natural resources under the surface of the land making them future royalty owners. This system of operation doesn’t work like this in other parts of the world as land ownership in those parts are owned by the state.

Because minerals can be owned privately in the United States, homeowners with valuable resources can sell to private companies, As a result, sometimes generating substantial up-front or ongoing royalties for the exploration and production of oil and gas.

These rights in Pennsylvania are those licenses to the surface interest of any property. This right covers the structure, farmland, or any above ground minerals like water bodies, trees and plants. This right was set according to Pennsylvania ordinances and local laws. You’re also allowed to install septic tanks.

With your license, you can lease or sell the title to the surface. However, you may not lease or sell the minerals below the surface area to any oil and gas, or mining company as those rights do not belong to you legally.

Sorting out ownership of mineral rights in Pennsylvania is not an easy process as many landowners have the insight to make moves. Many assume their mineral rights is intact but it may have been excluded during a sale.

To find this information, you will be required to follow these steps;

Getting the mineral records you seek in Pennsylvania can be a challenging task because it requires finding all the different owners of mineral rights. At times there are gaps in the search record which would require you to check public records. You have to search for all transactions to accurately determine the mineral owners.

This action makes be too complex and would require the help of professionals to run the title and get the required information. This may cost you quite a lot but you have the opportunity to gather accurate information on property records.

You can also search online on the county’s property records for a small fee. This will save time and would be convenient than showing up at an office to search the records.

To claim mineral rights in Pennsylvania, follow these steps:

Pennsylvania’s inheritance tax has drawn attention to the valuation of both mineral rights and natural gas benefits associated with the development and leasing of Marcellus shale. Natural gas rights and mineral rights must be reported like all other types of assets on Schedule E of the Inheritance Tax returns.

Mineral rights taxable value is determined by the same method used to value any real or tangible personal property. Generally, a mineral right’s taxable value can be determined by either a bona fide sale or an appraisal. In the absence of a bona fide sale, a computed value can be determined by using the common-level ratio.

Additionally, if the interest was never sold and there is no computed value, then you have to value it at its actual worth.

Mineral rights can be sold in any Pennsylvania county for anything from $500/acre to $5,000+/acre. Isn’t that a pretty wide range? The reason for such a range is because the ranges depend on where you are located in Pennsylvania. The cost of your property is heavily influenced by where you are located.

Mineral rights value in Pennsylvania is affected by many factors. With all these factors playing an important role in the value, how can you get an exact cost of mineral rights per acre? To determine how much your mineral rights are worth, you have to put them up for sale. If you’re selling mineral rights in Pennsylvania, get the property in front of a large network of buyers.

By doing so, you will ensure that you find the buyer who can pay you the highest possible price for it.

The process of buying mineral rights in Pennsylvania is straightforward. Your attorney can begin evaluating the mineral rights to that property once the legibility on the database website has been confirmed.

After the property has been evaluated and purchased, you must register the property with the State’s land office. Pheasant Energy is a trustworthy broker that can handle the deal for you. You can find additional information can be found on their website.

Mineral rights are sold for various reasons, and every seller has their reasons. A debt may have to be repaid, you may want to fund a new project, or pay for education. They are all valid reasons. The sale of the mineral rights will result in you receiving much money upfront, as well as benefits that can be used to take care of these pending problems.

Let Pheasant Energy assist you in selling these rights on your behalf. You will receive the best offer for your royalties and mineral rights. Visit their website for more information.

To transfer mineral rights successfully, follow these steps:

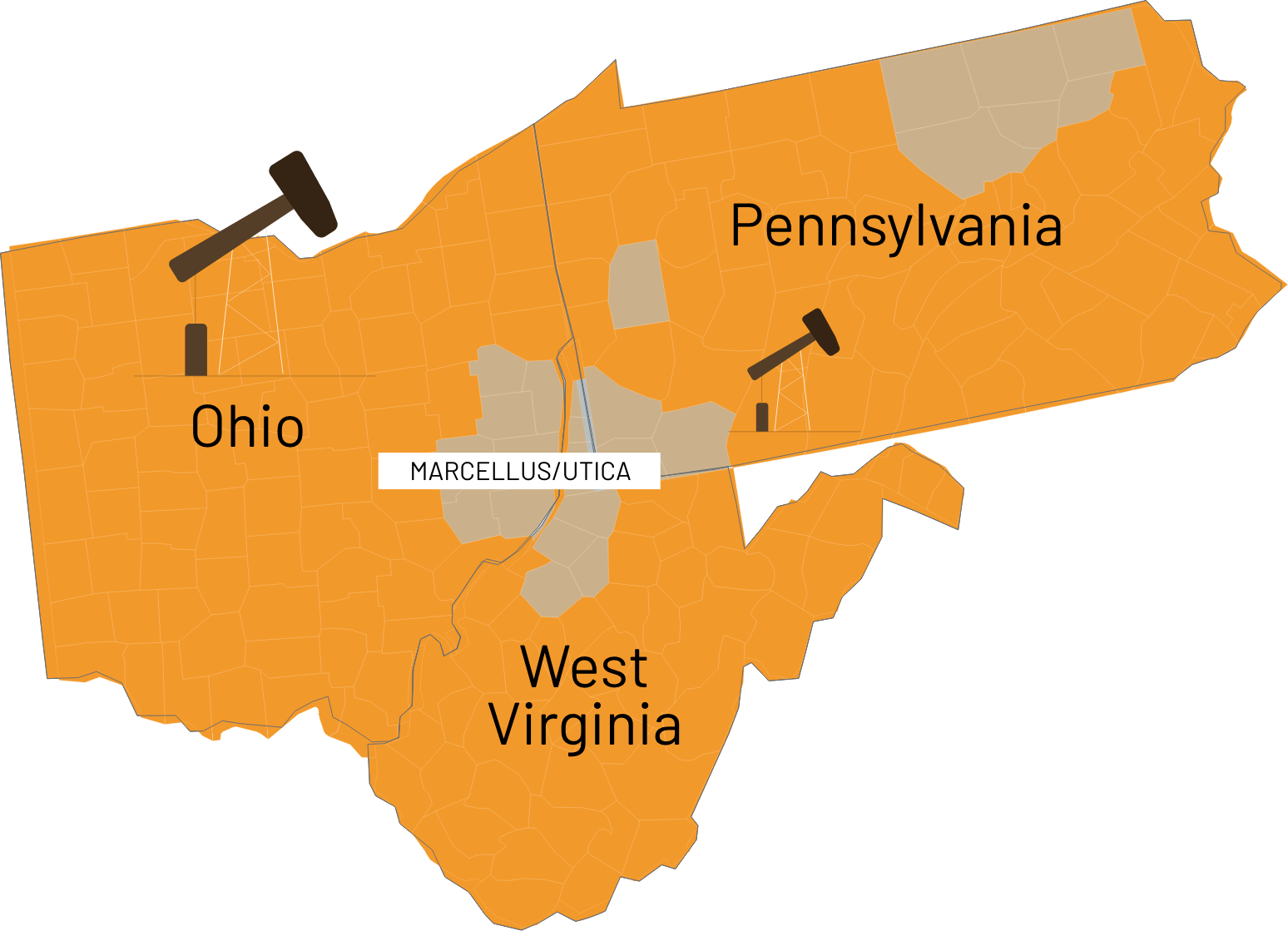

Currently, Pheasant Energy operates in:

These counties are all part of Marcellus/Utica Basin.

Yes, mineral rights (oil and gas) do expire in Pennsylvania. However, these rights are not returned to the surface owner as the mineral rights owner still have some claim over the minerals.

75+

1000+

100K+

Simple Steps

Give us a call at (817) 251-8282 or use our form in order to take the first step towards getting your offer.