In many states of the US, agriculture and oil are their major revenue sources so people need licenses to operate on such lands for what grows on them and what they have under them.

Wyoming ranks high among the US states when it comes to the resources above the ground and under the ground so for anyone to operate in the state successfully, they need to get either the mineral rights or the surface rights depending on your operations.

The rights to mineral resources found on any piece of land in Wyoming are divided into two, surface rights and mineral rights.

In Wyoming, purchasing a property does not come with surface or mineral rights.

All available acres of private land in Wyoming is in a split estate as a result of the Stock Raising Homestead Act of 1916 signed by President Woodrow Wilson so while the surface rights in Wyoming are privately owned, mineral rights are owned by individuals who lease the mineral rights to companies.

However, a settler could claim one section of non-irrigable land designated by the Secretary of the Interior as stock raising as provided by the act.

Wyoming is the seventh-largest oil producer, second-largest gas producer, and first largest helium producer in the United States.

The mineral rights in Wyoming have generated more than 2.2 billion dollars for the American government in form of tax to the local economy and state of Wyoming making it a lucrative business opportunity for the natives.

Wyoming has large scale land resources that can provide remarkable income to its owners. The value of mineral rights in Wyoming have tripled over the years due to recent innovations in obtaining minerals such as:

All these recent innovations in technology have improved the process of locating new oil wells and improving mining processes. Investing in mineral rights in Wyoming right now would make major sense due to these recent innovations.

Owning a piece of land in Wyoming does not necessarily mean you own the rights to the minerals under the ground.

In Wyoming, sometimes minerals are sold separately from the land’s property rights in a twist called a split estate.

The split estate method of operations is more prevalent in areas with numerous natural resources such as Wyoming as the land is rich in gas deposits and natural oil which makes mineral rights in this state very lucrative.

Surface rights are the rights to the surface area of land in Wyoming. This right includes the structures on the property and the rights to farm the land or own above-ground resources like plants, trees, and water inclusive.

With this right, you can sell or transfer the land surface title to anybody but you can’t sell or lease the resources beneath the ground.

With the system of operation in Wyoming, people can find the mineral rights to any land before they complete the purchase. If you don’t know the minerals under your soil, the only way to get private information is to do research.

As individuals, you can conduct this research by going through property records and historical deeds.

However, many states in the US don’t follow the public land survey system so it may be very challenging to determine who owns what through a public record search.

At this point, you may want to hire professionals to conduct the title search on mineral ownership and develop an opinion. This service is quite expensive due to the work involved but it will let you quickly review your property records and determine the resources you have in the soil and who owns them.

The government of Wyoming has set up a Mineral tax division for all that concerns mineral resources in the state. So, when individuals sell the mineral rights to their lands or give up the land for lease and receive payment, they are to pay a certain percentage to the government.

Any income you earn from the sale or lease of your mineral right, you’re mandated to pay either severance, income, or ad valorem taxes.

Each of these taxes is for different entities:

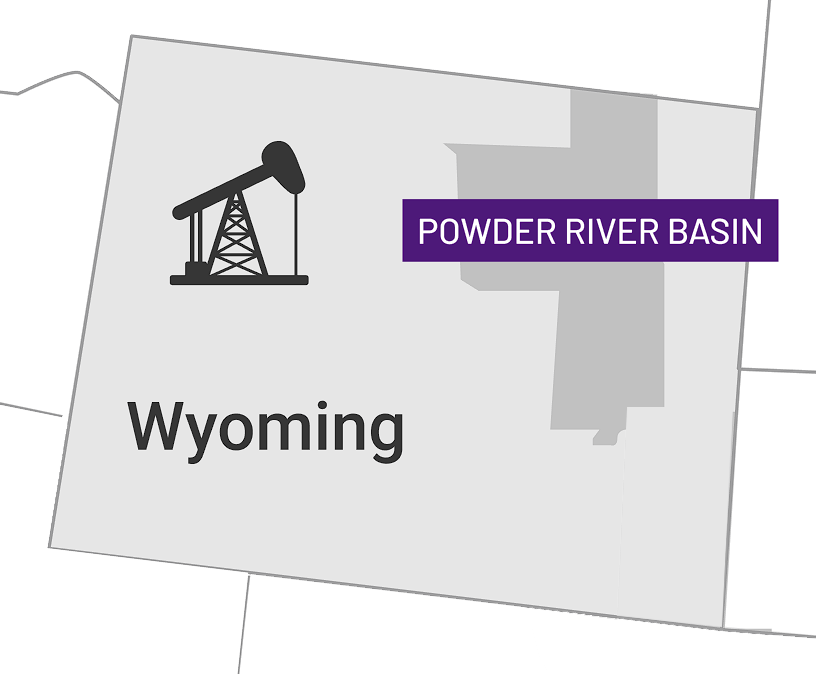

The value of mineral rights in Wyoming is determined by the location of the mineral in Wyoming.

Wyoming is rich in natural oil and gas deposits and contains some oil and gas fields. These fields are spread throughout the state making them one of the biggest US oil and gas producers.

Of all the different basins of resources in Wyoming, certain areas of Wyoming have more mineral resources than other areas. The quantity of minerals in these areas make the mineral rights have more value than other areas.

For example, the mineral rights in the greater Powder River Basin have more value than other basins in Wyoming because the area has seen the most activity in the state in terms of mineral resource production.

With the recent development in this area, the price of mineral rights has skyrocketed from $200 per acre in many areas in Wyoming to as much as $2,000 per acre presently.

There are still other basins that contribute to the value of mineral rights in Wyoming but their effect is not felt like that of Powder River Basin.

Those basins of mineral rights in Wyoming include:

If you’re considering buying any mineral right in Wyoming, you should look at the Niobrara Basin in the southeast of Wyoming and the Powder River Basin in the Northeast.

With the new development in these regions, investors who want to invest and cash out their profits early would need to make a move in these regions as they’re the high-value mineral rights site.

To complete this purchase, you would need brokers like Pheasant Energy.

We provide clients with informed views of their selected acres of lands and an invaluable strategic standpoint.

There are a lot of factors considered by Pheasant before making any recommendations. With our extensive experience in these regions, one can expect a tangible analysis of the mineral resources and the potential capability of the reserve production.

However, even though the decision to sell your mineral rights can be hurting, there are a few advantages it offers the seller such as the huge first payment you’ll receive for the lease.

This is a lot of money that can cater to many of your needs if you have them. Selling the rights can help the owner facilitate their estate settlement process before they pass on. The transitioning of mineral rights from generation to generation after death can be time-consuming and expensive especially if the probate process is used.

Selling off the rights and saving your kids the stress of sharing these rights would offer a more cost-effective solution.

Mineral rights are also not cheap in terms of taxes.

Transferring mineral rights from one individual to another is highly possible in Wyoming as the transfer is not a lease so there are no reservations or exceptions included.

The transfer of mineral rights includes the transfer of all rights concerning the oil, gas, and other mineral resources to a grantee.

The grantee upon receiving and completing the transfer process gains the right to access the mineral rights for exploration, mining, development, and drilling on the land for its mineral resources.

To transfer mineral rights:

The grantor’s lawyer has to come up with a deed of transfer to the grantee.

The grantee accepts the deed of transfer and goes on to register themselves as the new rightful owner at the office of state lands and investment.

After this process is completed, the new owner has to apply to become a member of the royalty association where they will update the royalty payment structure and the new owner can begin receiving payments.

Currently, Pheasant Energy operates in Plata, Goshen, and Laramie counties which are part of the Niobrara Basin while also operating in Johnson, Campbell, and Converse counties which are part of the Powder River Basin.

You can reach out to us on our website or email, and we would respond immediately.

Owning and leasing mineral rights in Wyoming has become a lucrative business.

With recent innovations in technology, areas that had little or no activity are now seeing wells spring up all over the land.

The price of royalties has also reached an all time high of $3000 per acre today so if you’re considering selling/leasing your mineral rights, you can contact Pheasant Energy today.

We can provide you with the estimated value of your rights and also purchase half or all of your rights.

Buying a property without mineral rights in Wyoming depends on your status and what you intend to gain from the property. This choice is one that’s left for the buyer to make. However, you can buy a property after conducting due diligence to see that no one own the surface or mineral rights to the land. This way your intent for the land is not interfered with in the future.

No. Nobody owns the mineral rights to their property except the property has been in the family for generations. The mineral rights to land are usually owned by private entities or by the government in some cases. You have to do due diligence on any piece of land if you’re considering making a purchase.

75+

1000+

100K+

Simple Steps

Give us a call at (817) 251-8282 or use our form in order to take the first step towards getting your offer.